Blog

Platform and Industry updates

-

07/09/2025

Does the Alternative Investment Market Actually Need an Interest Rate Cut?

Here at 9AT we, obviously, would like to see the alternative investment industry thrive and grow.

So, the additional interest rate cuts that we, and many others that we talk to - whether we’re out and about at industry conferences, or just during the course of our working week – were hoping for at the beginning of the year, which should, other things being equal, support fundraising and deal activity, are yet to materialize.

Ignore the politics for a minute and let’s look at some of the data. The most recent jobs data published at the beginning of the month showed nonfarm payroll up by 147,000 in June, which is in line with the average monthly gain of 146,000 over the prior 12 months. And job data for April and May have been revised upwards since the original data was released for those months.

So, more Americans now have more money. That is not a recipe for lower rate expectations.

Next, inflation. While inflation rates have plateaued to around 3% - regularly less – since the middle of 2023, the rate has ticked up in the past couple of months which could give hawks more reason to resist President Trump’s calls for a 300 basis point cut.

Again, that is hardly a leading indicator for a rate cut.

But does the alternative investment industry need one? Hedge funds could well point to the first half of 2025 being good – the HFRI is up 3.77% year to date and 8.54% in the last 12 months. Part of the reason for the good performance so far could be market volatility, which is generally a tailwind for hedge funds (or is supposed to be). And the returns in the ZIRP environment of the post-GFC decade certainly weren’t amazing (on average).

And higher rates are a tailwind to certain private credit strategies as well. Many loans by private debt funds are floating rate, so the higher the interest rate, the higher the IRR (let’s ignore the higher risk of loans becoming non-performing for now).

And demand for private credit is set to continue, according to HSBC, to the tune of $3trn in the next three years. And McKinsey says that private markets generally are set to see greater allocations from limited partners in the coming year.

There is no doubt that lower rates support fundraising in alternatives as investors look for investments that can generate an acceptable yield. And lower rates support increased activity in private equity as the cost of financing deals falls.

But lower rates support zombie companies, whereas higher rates do not. And higher rates help to separate the great from the good in the sense that a higher-cost regime makes a private markets fund or a hedge fund really earn their fees by delivering good performance in a more challenging environment.

What happens with interest rates remains to be seen, of course. But from the conversations we have been having, we don’t think that the lack of a rate reduction so far this year has been a significant drag on the alternative investment industry.

Editor's Picks:

- Hedge funds seek to expand into private credit

- Private Credit Can Bring Risk Along With Liquidity to Commercial Property Finance

- Trump reportedly preparing order to open 401(k) plans to private market assets

- The Office Market Recovery is Here, Just Not Everywhere

- Why AI will eat McKinsey’s lunch — but not today

-

05/08/2025

New Fund Launches Strong in 2025 Thus Far Despite Tariff Uncertainty

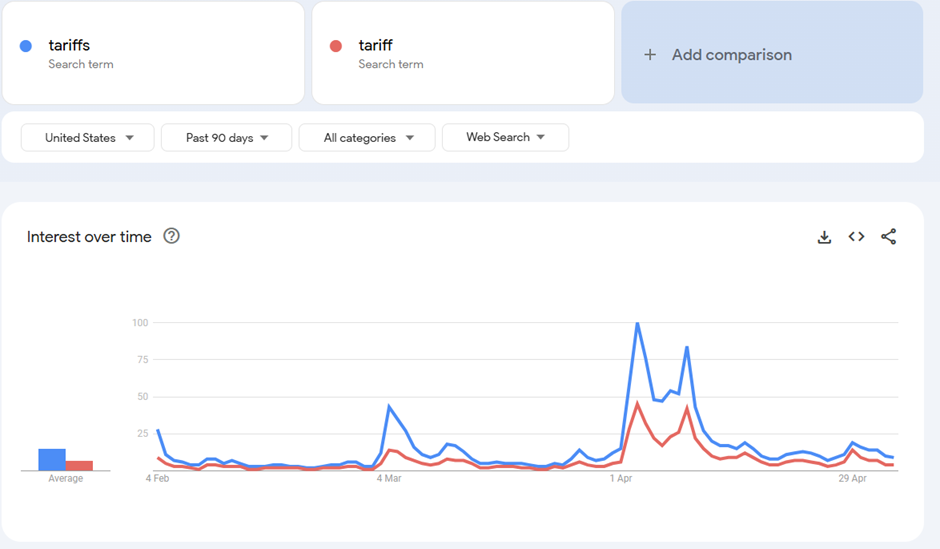

Tariffs. It is probably the most uttered word in macroeconomic and government policy circles since the beginning of the year. And it was certainly a commonly searched word on the internet in April – Google Trends tells you how popular a certain term is during a certain time frame, and interest peaked in early April, when President Trump implemented a swath of them to varying degrees of intensity (the chart below shows the relative trend for a search term – the higher the peak, the more it was searched for in the selected time period).

Figure 1: Google Trends, “Tariffs” and “Tariff”, past 90 days

But what is the impact of the tariffs on the US private funds industry?

Well, there are a few ways to answer that question; one of which is to look at new fund launches.

According to the 9AT database, 4,333 new funds have been filed in the first four months of 2025, worth $80.9bn of capital under management at least – some funds file their Form D before the first allocations are made, so that number will only increase over time as they file their Form D/A in subsequent years. And notably, this year’s data represents a significant uplift over last year, when 2,604 new funds worth $38.4bn were filed – good for increases of 66.4% and 110.7% respectively.

This year’s data should be considered strong by any standard, but even more so when compared to the same period in 2024. And while it is not possible to know the extent of the impact of tariffs on investor demand for private fund strategies, given that many funds - especially in private equity, real estate and venture capital - are closed-ended, 10-year duration vehicles, investors take a longer view when they allocate to these products by definition, so it is still too early to understand how persistent the tariffs will be, and therefore, the extent of the impact of them on performance.

And it is performance which is the main determinant of future demand for a product. If something does well, investors want in, and vice versa.

And 2025 is certainly delivering interesting numbers in the hedge fund space. The HFRI 500 Fund Weighted Composite Index was down -3.77% year to date through the end of March (hedge funds as an overall sector follow the equity market as the bulk of the money is in equity-related strategies).

But then the S&P 500 notched its longest winning streak since November 2004 in late April, essentially covering the losses from the beginning to the middle of the month.

It is difficult to ascertain how the events of the first few months of the year will impact private market strategies, however.

For the new venture capital funds that have launched in the past few months, investors will already be expecting to be on the downward slope of the j-curve, so no surprises there – the question is whether the turning point becomes delayed or not.

Private equity could be more exposed, but it will be limited to a certain extent to those funds that have exposure to import industries, such as manufacturing and consumer goods & retail. Those funds with investments in software, professional services and finance are likely to be less affected.

It is a similar story in private credit, but the reduction in interest rates towards the back end of 2024 will have provided some buffer for borrowers as most of the loans in the space are floating rate.

One interesting observation in the public markets can be seen in the stock price performance of some of the listed alternative asset managers. At the time of writing, KKR was down -23.16% year to date, Blackstone down -22.28%, Apollo down -21.71%, Carlyle down -20.84%. Compare that to the S&P 500 SPDR ETF (down -4.65%) and these stocks have underperformed this year. There could be a few reasons for that – profit taking for one, as some of these stocks actually outperformed the S&P ETF on a rolling one-year basis. Concerns about the impact of tariffs on portfolio companies, whether private debt or equity, could be another.

Whatever the reason, the global economy would still seem to be in the early innings of the tariffs game, but encouraging signs came at the beginning of May, when the US reached out to China to discuss a possible trade deal (which itself likely helped lift the equity market) – buy the dip, anyone?

What the ultimate impact will be is anyone’s guess. But, at $80.9bn of capital allocated to private funds through April, it seems that some capital allocators have plenty of confidence that US private fund strategies can continue to deliver them the returns they need, even if the new funds are launching at a time of unprecedented macroeconomic change.

Editor's Picks:

- Blackstone's King of Hedge Funds on Alt Investing Right Now

- Leveraged loan default rate dips to 0.73%, but LMEs send dual-track gauge higher

- Private equity’s bind should prompt an investor rethink

- Signals on Private Real Estate amid Trade Turmoil

- VCs lambast visa barriers under second Trump administration

-

04/16/2025

Private Fund Auditor Changes Creep Up in 2024

April in the United States is tax filing month – at least, for individuals (unless they get an extension to October). And in the private funds’ world, it is also notable for being the month when we get an accurate picture of the previous year’s Form ADV filings, given that private fund managers with a December 31st year end tend to leave it late and file in March (they have up to 90 days after their year-end to do so).

A lot of interesting information can be gleaned from the Form ADV documents, including which funds changed auditor in the past year. We conducted this exercise in 2024 and found that 2,373 private funds took the plunge and switched arguably their most investor eyebrow-raising service provider.

So, we’re doing it again this year. And the headline is that in 2024, auditor changes increased.

3,201 funds changed their auditor, a nominal increase from the previous year in both absolute terms and when looked at as a percentage of funds outstanding; of the eligible universe, 2.9% of funds changed auditors in 2024 vs. 2.6% last year.

Reasons abound as to why a private fund adviser might switch their auditor; cost savings, a key person moving to a new provider (which is not easy to do given the non-competes in the US) or a perceived superior offering, to name a few.

But the private fund could also just as easily have been fired by the auditor – that’s not good, and so tough questions are asked of a private fund manager that changes their auditor – especially in the hedge fund space, which tend to be open-ended, and therefore easier for an investor to redeem.

Figure 1: US Private Fund Auditor Changes, by Fund Type, 2024

Fund Type Number of Funds Changed Total Number of Funds % of Funds that Changed Auditors ‘Other’ 491 10,477 4.7% Real Estate 269 7,367 3.7% Hedge Fund 611 17,550 3.5% Private Equity 1,181 39,491 3.0% Venture Capital 642 33,085 1.9% Source: 9AT

*Securitized Asset Funds and Liquidity Funds are excluded due to lack of statistical significance

Once again, the usual suspects feature heavily in the ‘firms which took share’ league table. In 2023, the top five overall, in order, were Deloitte, PwC, KPMG, RSM and EY. In 2024, the top five overall were, in order, Deloitte, KPMG, PwC, EY, and BDO.

What is interesting, however, is what is under the hood. Separating the league tables into fund types shows Cohn Reznick making a splash in the private equity and real estate categories; the firm did not feature in the top five auditor replacement league table last year. And neither did Calvetti Ferguson, third in the venture capital list this time – although, all of the firm’s 76 fund gains were by just one adviser, Claritas Capital.

Figure 2: US Private Fund Auditor Changes, by Replacement Auditor, 2024

Rank Overall Private Equity Venture Capital Hedge Fund ‘Other’ Real Estate 1 Deloitte Deloitte Frank, Rimerman & Co Deloitte KPMG Deloitte 2 KPMG PwC BDO PwC Deloitte EY 3 PwC KPMG Calvetti Ferguson BDO PwC Cohn Reznick 4 EY EY EY Baker Tilly BDO KPMG 5 BDO Cohn Reznick KPMG KPMG EY Cohen & Company Source: 9AT

Across the five largest categories of funds available for selection on Form ADV, non-Big Four audit firms feature nine times out of 25. That is down one from last year, when 12 spots were claimed by these firms. The total number of firms featured on the table above is just 10.

Changing fund administrator is, in theory, less of a potential investor eyebrow-raiser than switching auditor, and indeed, some closed-ended private funds even administrate their own funds as opposed to hiring an independent one.

It should be little surprise, therefore, that the number of private funds that changed their admin in 2024 was higher – but it might be a surprise that the number was not significantly higher. 3,943 funds got themselves a new fund administrator last year, good for 3.5% of the total.

Figure 3: US Private Fund Administrator Changes, by Fund Type, 2024

Fund Type Number of Funds Changed Total Number of Funds % of Funds that Changed Admins Securitized Asset Fund 770 3,480 22.1% ‘Other’ 517 10,477 4.9% Hedge Fund 643 17,550 3.7% Private Equity 1,139 39,491 2.9% Real Estate 207 7,367 2.8% Venture Capital 667 33,085 2.0% Source: 9AT

*Liquidity funds excluded due to lack of statistical significance

The top five admin firms are, like their auditor cousins, well known for their presence in the administrator market but their lofty league table positions do not mirror the audit category in terms of dominance. The market share among admin firms is much flatter when compared to the significant drop-off from the Big Four audit firms to fifth position, so the likelihood of significant changes next year are higher here.

What is also notable about Figure 3 is the presence of securitized asset funds. We took a closer look at these products last month, and 770 (or a whopping 22%!) of them changed administrator last year.

There is a wider distribution of firms in the fund administrator replacement league table, making the space less concentrated than the auditor one. A total of 17 firms feature in the six sub-categories in figure 4 below, but removing the Securitized Asset Fund category (to provide an apples-to-apples comparison with the auditors) shows just 12 firms in total, only two more than in Figure 2; by removing Securitized Asset Funds from the “All” category, Maples and US Bank come out, Apex and SS&C move up and Juniper Square enters fifth place in the overall standings.

Figure 4: US Private Fund Administrator Changes, by Replacement Administrator, 2024

Rank Overall Private Equity Securitized Asset Fund Venture Capital Hedge Fund ‘Other’ Real Estate 1 NAV Consulting Standish Management Maples Aduro Advisers NAV Consulting SEI Apex 2 Maples Apex US Bancorp Carta SS&C NAV Consulting Gen II 3 Apex Alter Domus Walkers Juniper Square Apex SS&C Juniper Square 4 US Bancorp Juniper Square Bank of New York Mellon Standish Management Hedgeserv Apex SS&C 5 SS&C NAV Consulting FIS Global NAV Consulting SEI IQ-EQ Alter Domus Source: 9AT

Whether the increase in auditor replacements is a trend remains to be seen – our regular readers will need to wait until next year to find out, at which time we’ll also have a year-on-year comparison for the administrators.

But what can be deduced from last year’s Form ADVs is that more managers were willing to change their auditor than in the prior year – and the continued use of the Big Four to replace the incumbent suggests that cost cutting is less likely to be a reason why private fund advisers switch.

Editor's Picks:

-

03/11/2025

Securitized Asset Funds…

When most people in the US private funds industry think of Form ADV – the uniform form used by investment advisers to register with both the SEC and state securities authorities – they’re most likely thinking of hedge funds, private equity funds, and venture capital funds. They might even be thinking of private credit funds - although this is not technically an option on the form itself (time for an update, perhaps?) and so these products often appear in the ‘Other private fund’ category.

The point is, they’re less likely to be thinking of Securitized Asset Funds – those whose “primary purpose is to issue asset backed securities and whose investors are primarily debt-holders.”

The reason is probably because most private fund managers don’t offer these products. A look at 9AT suggests that out of almost 13k private fund managers reporting to the SEC, only 247 have securitized asset funds reported on their ADV’s.

Relative to two other large private fund categories, hedge funds and private equity funds, the number of securitized asset funds lags far behind. There are currently a total of 3,286 securitized asset funds in our database, as reported on ADVs; 105 of them first appeared in 2025 filings, thus far. Compare that with hedge funds - 22,792 in our database, 1,347 from 2025 filing s- and private equity - 40,812 in our database, 1,464 from 2025 filings.

It’s clear, then, that these funds are a smaller part of the private fund market – at least, from a quantity perspective.

However, on average, securitized funds tend to be larger in size. Cost is a significant reason why securitized funds are larger. Collateralized Loan Obligations (CLOs) – which make up a good chunk of the market - need to be significantly larger than the average private fund in the U.S. due to the substantial fixed costs associated with structuring, issuing, and managing these vehicles. Unlike a basic equity hedge fund, for example, which can be launched with a relatively lean operational setup - typically requiring capital for legal structuring, regulatory filings, a Bloomberg terminal and initial marketing - a CLO involves extensive securitization processes, credit ratings, and ongoing compliance requirements. Key costs include legal fees for structuring complex tranche-based securities, arranger fees paid to investment banks that structure and distribute the CLO, and rating agency fees to assess the creditworthiness of the different tranches. Additionally, CLOs incur trustee and administrative costs, collateral management fees, and audit expenses, all of which contribute to a higher operational break-even point compared to a lean equity hedge fund.

The size required to launch a securitized fund significantly reduces the pool of asset managers who might launch these products. Indeed, you look at the sponsors, you see a ‘who’s who’ of private fund managers. In this year’s filings, KKR, Schroders, Cheyne Capital, Onex Credit Partners, Goldentree Asset Management, Cerberus Capital Management, Oaktree Capital, Bain Capital have all issued securitized asset funds, according to 9AT.

So, which firms service these products? CLOs aren’t required to take on an auditor. However, custodians and administrators - more commonly referred to as trustees and collateral administrators - are the main service providers vying for business.

Of the new ones in 2025 filings, 37 securitized asset funds did not list an admin provider, US Bank leads the pack so far this year with 19, as can be seen from Table 1 below. Citi moved to #2 with 12 funds. Interestingly, the firm did not feature at all on the list of top 3 admins for newly issued funds in 2023 or 2024.

What is apparent from the data is that US Bank has consistently led the pack in the last few years.

Table 1 – Top 3 Administrators of newly reported Securitized Asset Funds, by year by fund count

Administrator 2025 Administrator 2024 Administrator 2023 US Bank 19 US Bank 83 US Bank 89 Citi 12 Computershare 44 BoNY 34 FIS Global 7 BoNY 28 FIS Global 32 The custody side (aka trustee) also sees US Bank off to an early lead this year, as it led in both 2024 and 2023. And, similarly to the administrator category, Citi and BoNY have a significant presence here as can be seen in Table 2 below, as does Computershare, which, while not yet appearing in the top three this year, has done so last year. Citi placed fourth last year by fund count.

Table 2 – Top 3 Custodians of newly reported Securitized Asset Funds, by year by fund count

Custodian 2025 Custodian 2024 Custodian 2023 US Bank 25 US Bank 116 US Bank 117 Citi 22 Computershare 55 Citi 55 BoNY 14 BoNY 48 BoNY 50 The securitized funds market is a fairly small one in terms of the broader private funds industry, and there is significant concentration in it. Of the 3,977 private funds reported so far in 2025, with a total GAV of $351bn, the 105 securitized asset funds represent only 2.6% of the quantity and 8.7% of the total GAV reported thus far in 2025. And those 105 funds are managed by just 34 advisers.

Looking at the tables above, the key service providers to these funds are themselves larger firms, which is perhaps little surprise when considering the corresponding size of typical securitized funds and the asset managers running them.

And, while the custodian category seem to be reasonably consistent in terms of the firms that feature towards the top of these league tables, the administrator category could be where this market sees movement in 2025. We’ll be keeping an eye on this space to see what happens!

Editor's Picks:

- Hedge funds still have big bets on the market, even if they’re less bullish

- Private debt and growth equity to drive private markets fundraising in 2025

- Private equity industry shrinks for the first time in decades

- The outlook for the US housing market in 2025

- Stanford VC Initiative Study: How Long Does It Take To Build A Unicorn?

-

02/12/2025

In-Person Networking Remains Essential for US Private Funds Industry

The lockdowns initiated at the onset of the Covid-19 pandemic five years ago impacted our market significantly. Investor relations professionals had to try and raise money over video conference technology like Zoom and service provider sales reps – who need to meet potential clients personally as well - had to do business digitally also.

And adapting to working at home was, at first, challenging, until the ‘new normal’ (remember that term?) became…just normal.

Working from home is now a feature of our industry (and many others). But the pandemic was, for many industries, not only the private funds space, a test of the value of the in-person connection.

It is a test that the in-person interaction won, and did so handsomely.

Like many others in the private funds industry, we at 9AT are largely settling back into working normality after being in Miami at the end of January for the Uncorrelated conference, at which we enjoyed not only seeing so many of our current clients but connecting with new faces from across the spectrum of our industry – allocators/investors, private fund managers and service providers alike.

For those of you that attended - we hope you found the events worth your time. We certainly did – catching up with clients and making new connections, whether they be potential customers or those we can help in other ways, such as referrals.

What struck our team most about the events wasn’t its scale – we expected a good turnout, and a good turnout was delivered – but it reminded us just how important networking and relationships are to our industry.

But something has changed since the Covid-19 pandemic. For many years pre-pandemic the fund managers and service providers made up the majority of the attendees at the myriad of industry conferences in our space.

But what we noticed in Miami is that more allocators/LPs seem to be making the trip to the sunshine state to meet potential new managers and make new connections.

That trend is one that we have heard anecdotally from others in the market as well. And while there are many benefits of doing so – nice weather and networking with other allocators/investors (who could be a future employer..!) being just two – it speaks to the value that more allocators/investors see in more face time with their managers.

Previously, many LPs would spend significant amounts of time in the initial due diligence phase before making an allocation, and then face time would decrease significantly – sometimes, only at the fund manager’s annual investor meeting (if they attended it at all). Now, investors are deliberately seeking out their managers when going to events, or on the road conducting due diligence on a different manager.

Managers are telling us that there is a similar trend happening in the pre-allocation phase. Getting on a ‘watch list’ again involved significant due diligence hours for both the manager and the LP, and then anything in-person after that would be rare, unless the LP was gearing up to make an investment. These days, the money is much more willing for a manager to just stop by their office when in town for something else.

That doesn’t mean that things like video technology is a flash in the pan. Have you noticed how much you do video calls as opposed to phone calls now? And there are plenty of meetings that can happen digitally.

But the post-pandemic US private funds industry is showing just how important in-person networking is to our space, whether that be investors, managers, or service providers. Here at 9AT we are fortunate to have customers from across the spectrum of the private funds industry, and we look forward to seeing you – in person – at a future event.

P.S. – A quick observation about the Miami conference scene generally. Obviously this was the first year that MFA and iConnections partnered up on their event, which was at the Miami Beach Convention Center, as opposed to the Fontainebleau. Some folks we spoke to thought that while the conference was good, they preferred it in the hotel as there would be less time spent in a cab and more time at the events. It will be interesting to see what they do next year. And we’re a little biased as a sponsor, but we thought the Uncorrelated event, as we mentioned above, was great, and even more so given it was their first year. For those of you that we saw there, we hope that you liked the 9AT baseball caps…

Editor's Picks:

-

01/14/2025

Mixed Bag for Private Fund Fundraising in 2024

Are you an optimist or a pessimist?

If you consider yourself the former, and you had gone through the Form D filings in 2024, you would be feeling pretty good about the state of the private fund fundraising space. After all, there were 21 more Form D documents filed with the SEC

last year (15,248) than there were in 2023 (15,227). That is an increase of 0.00% to two decimal places, but a win is a win, as they say.

If you are a pessimist, then you would look at the aggregate gross asset value (GAV) and tell people that things are bad. And, from a data perspective, you would be right – the total GAV fell from $325.5bn in 2023 to $266.01bn last year, a drop of -18.28%. You would also likely point out that the total GAV was $485.08bn in 2022, so 2024 delivered a second consecutive year of declines.

The Form D provides private fund advisers with four sub-category options for ‘pooled investment funds’ – hedge fund, private equity fund, venture capital fund, and other investment fund.

Each of these categories has evolved into its own industry, managing billions of dollars of investor capital across numerous geographies and asset classes. So, at the filings level, there was a noticeable uptick in activity in the hedge fund and private equity fund categories and on the other side, a decline in venture capital funds , as can be seen in Table 1 below.

Table 1: Number of Filings by Form D Category, 2024 vs 2023

Category Filings (2022) Filings (2023) Filings (2024) 2024 v 2023 Change (%) Hedge Fund 1,390 1,086 1,190 9.6 Private Equity Fund 4,446 3,629 4,104 13.1 Venture Capital Fund 9,079 6,546 6,051 -7.6 Other Investment Fund 4,390 2,616 2,585 -1.2 Other* 1,870 1,350 1,318 -2.4 Total 21,175 15,227 15,248 0.1 *Other represents Form D funds that weren't marked as pooled investment funds in Section 4

Alas, it is not the same story at the GAV level. Interestingly, venture capital funds delivered the year’s good news story in terms of total dollars raised, seeing an increase of 27.6% from last year, implying less in number but a much larger average fund size. And the private equity cohort added a couple of percentage points, as shown in Table 2.

Table 2: Aggregate GAV by Form D Category, 2024 vs 2023

Category GAV (2022) GAV (2023) GAV (2024) 2024 v 2023 Change (%) Hedge Fund 57.13 87.12 47.94 -45.0 Private Equity Fund 165.80 95.12 97.39 2.4 Venture Capital Fund 135.47 26.62 33.96 27.6 Other Investment Fund 109.78 108.63 76.93 -29.2 Other* 16.90 7.99 9.80 22.7 Total 485.08 325.50 266.01 -18.3 *Other represents Form D funds that weren't marked as pooled investment funds in Section 4

The GAV for hedge funds fell significantly, however. In 2023, total GAV was $87.12bn, so hedge funds raised only slightly more than half that last year.

Reasons for the struggles in hedge fund land are well documented. Rightly or wrongly, their returns are often compared to the S&P 500, which in 2024 gained approximately 25%. Add to that the recent higher interest rate environment dampening appetite for products that, on average, delivered 7.99% at the time of writing (according to BarclayHedge) and it becomes clear that the hedge fund industry faces competitive challenges.

The numbers, however, do not paint a perfect picture of the health of fundraising in the space. Many Form D filers submit their document before they have raised any outside assets, so in these instances, the form itself shows $0 in sales.

So, when these funds file their Form D/A, we would expect AUM to tick up here over the next 12 months – and significantly so.

One thing that won’t be a surprise is the dominance of private equity funds in the league tables. These products are usually larger in size than their hedge fund cousins due to the nature of the strategy, and thus provided the biggest winners again in 2024 (these products also topped the charts in 2023). Of the top 20 filings last year, 16 were private equity, two were venture capital and two were ‘other’.

Table 3: Top Twenty Form D Filings, Jan 1 – Dec 31, 2024, by Gross Asset Value Size

Fund Name GAV ($ billions) Type Linden Capital Partners VI LP 4.5 Private Equity Fund Linden Capital Partners VI-A LP 4.5 Private Equity Fund KLCP Offshore Fund IV LP 4.0 Private Equity Fund KLCP USTE Fund IV LP 4.0 Private Equity Fund KLCP Domestic Fund iv LP 4.0 Private Equity Fund Asterion Industrial Infra Fund III, FCR 3.9 Private Equity Fund Nautic Partners XI-A, LP 3.8 Private Equity Fund Nautic Partners XI, LP 3.8 Private Equity Fund Thrive Capital Partners IX Growth, LP 3.5 Venture Capital Fund Pomona Capital XI (Offshore), LP 3.5 Private Equity Fund Pomona Capital XI, LP 3.5 Private Equity Fund Columbia Spectrum Partners VI-A, LP 3.2 Other Ninety One Global Alternative Fund 2 SCSP - RAIF - Africa Credit Opportunities Fund 3A 3.0 Other Arch Venture Fund XIII, LP 3.0 Venture Capital Fund Blue Torch Credit Opportunities Fund IV LP 3.0 Private Equity Fund Blue Torch Offshore Credit Opportunities Fund IV LP 3.0 Private Equity Fund Stellex Capital Partners III-A LP 3.0 Private Equity Fund Stellex Capital Partners III LP 3.0 Private Equity Fund Sterling Group Partners VI (parallel), LP 2.8 Private Equity Fund Sterling Group Partners VI, LP 2.8 Private Equity Fund *On occasion, filers may put the same GAV on multiple filings for the same product, which can lead to double counting in certain situations

Whether you are an optimist or a pessimist, there is something for everyone in the Form D data from 2024. And, despite the headline GAV numbers for hedge funds in particular being perhaps a little alarming, there are clearly mitigating circumstances.

But for the private equity and venture capital set, it is difficult to argue that 2024 was not a better year than 2023. And for the private funds industry overall, the back end of last year delivered some good news in the form of reductions in the Federal Funds Rate, which, other things being equal, will hopefully drive some investors to rotate back into private funds. The aforementioned spike in the S&P 500 might also see some investors overweight US equities as well, which might also be a boon for the alternative investment industry.

As always, we will be keeping an eye on developments.

Happy New Year!

Editor's Picks:

- Volatility, dealmaking, macro uncertainty pave path for hedge fund performance in 2025

- Private credit may end up looking a bit more like a bank

- M&A 2024: Rebounding from rates and regulations

- The Risks of Appraisal Uncertainties in Private Real Estate

- Number of US venture capital firms falls as cash flows to tech’s top investors

Previous

Previous