Blog

New Fund Launches Strong in 2025 Thus Far Despite Tariff Uncertainty

05/08/2025

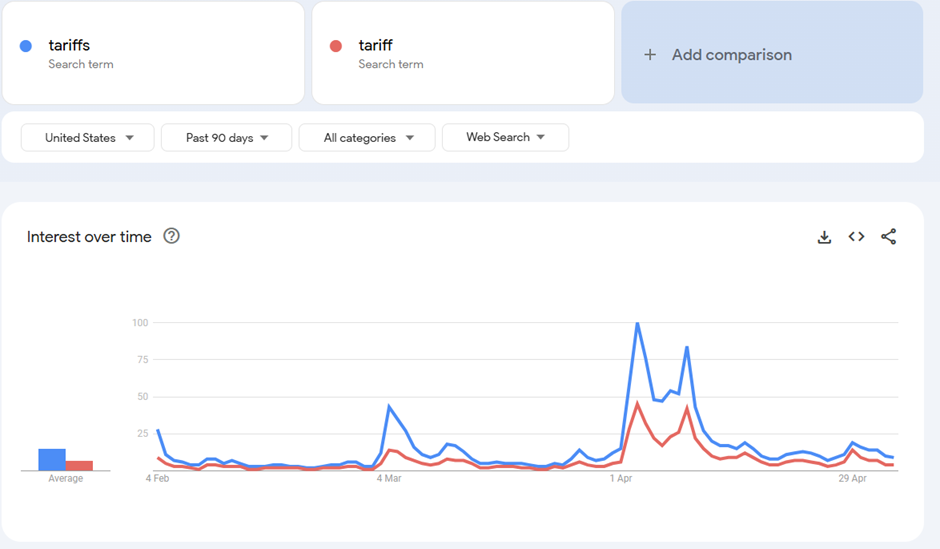

Tariffs. It is probably the most uttered word in macroeconomic and government policy circles since the beginning of the year. And it was certainly a commonly searched word on the internet in April – Google Trends tells you how popular a certain term is during a certain time frame, and interest peaked in early April, when President Trump implemented a swath of them to varying degrees of intensity (the chart below shows the relative trend for a search term – the higher the peak, the more it was searched for in the selected time period).

Figure 1: Google Trends, “Tariffs” and “Tariff”, past 90 days

But what is the impact of the tariffs on the US private funds industry?

Well, there are a few ways to answer that question; one of which is to look at new fund launches.

According to the 9AT database, 4,333 new funds have been filed in the first four months of 2025, worth $80.9bn of capital under management at least – some funds file their Form D before the first allocations are made, so that number will only increase over time as they file their Form D/A in subsequent years. And notably, this year’s data represents a significant uplift over last year, when 2,604 new funds worth $38.4bn were filed – good for increases of 66.4% and 110.7% respectively.

This year’s data should be considered strong by any standard, but even more so when compared to the same period in 2024. And while it is not possible to know the extent of the impact of tariffs on investor demand for private fund strategies, given that many funds - especially in private equity, real estate and venture capital - are closed-ended, 10-year duration vehicles, investors take a longer view when they allocate to these products by definition, so it is still too early to understand how persistent the tariffs will be, and therefore, the extent of the impact of them on performance.

And it is performance which is the main determinant of future demand for a product. If something does well, investors want in, and vice versa.

And 2025 is certainly delivering interesting numbers in the hedge fund space. The HFRI 500 Fund Weighted Composite Index was down -3.77% year to date through the end of March (hedge funds as an overall sector follow the equity market as the bulk of the money is in equity-related strategies).

But then the S&P 500 notched its longest winning streak since November 2004 in late April, essentially covering the losses from the beginning to the middle of the month.

It is difficult to ascertain how the events of the first few months of the year will impact private market strategies, however.

For the new venture capital funds that have launched in the past few months, investors will already be expecting to be on the downward slope of the j-curve, so no surprises there – the question is whether the turning point becomes delayed or not.

Private equity could be more exposed, but it will be limited to a certain extent to those funds that have exposure to import industries, such as manufacturing and consumer goods & retail. Those funds with investments in software, professional services and finance are likely to be less affected.

It is a similar story in private credit, but the reduction in interest rates towards the back end of 2024 will have provided some buffer for borrowers as most of the loans in the space are floating rate.

One interesting observation in the public markets can be seen in the stock price performance of some of the listed alternative asset managers. At the time of writing, KKR was down -23.16% year to date, Blackstone down -22.28%, Apollo down -21.71%, Carlyle down -20.84%. Compare that to the S&P 500 SPDR ETF (down -4.65%) and these stocks have underperformed this year. There could be a few reasons for that – profit taking for one, as some of these stocks actually outperformed the S&P ETF on a rolling one-year basis. Concerns about the impact of tariffs on portfolio companies, whether private debt or equity, could be another.

Whatever the reason, the global economy would still seem to be in the early innings of the tariffs game, but encouraging signs came at the beginning of May, when the US reached out to China to discuss a possible trade deal (which itself likely helped lift the equity market) – buy the dip, anyone?

What the ultimate impact will be is anyone’s guess. But, at $80.9bn of capital allocated to private funds through April, it seems that some capital allocators have plenty of confidence that US private fund strategies can continue to deliver them the returns they need, even if the new funds are launching at a time of unprecedented macroeconomic change.

Editor's Picks:

- Blackstone's King of Hedge Funds on Alt Investing Right Now

- Leveraged loan default rate dips to 0.73%, but LMEs send dual-track gauge higher

- Private equity’s bind should prompt an investor rethink

- Signals on Private Real Estate amid Trade Turmoil

- VCs lambast visa barriers under second Trump administration

Previous

Previous